Content

- How to Calculate Straight Line Depreciation (Step-by-Step)

- Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

- Straight-line method of depreciation

- How Much Does Commercial Property Insurance Cost?

- Formula Example: Diminishing Value Method for Tax

- Straight Line Depreciation Calculator

A half-year convention for depreciation is a depreciation schedule that treats all property acquired during the year as being acquired exactly in the middle of the year. Full BioAmy is an ACA and the CEO and founder of OnPoint Learning, a financial training company delivering training to financial professionals. She has nearly two decades of experience in the financial industry and as a financial instructor for industry professionals and individuals. Estimate the asset’s salvage value, or how much it can be sold for at the end of the useful life. Straight-line depreciation is easy to calculate and consistently applied. Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret and act on emerging opportunities and trends. Therefore, Company A would depreciate the machine at the amount of $16,000 annually for 5 years.

Do not rely upon the information provided in this content when making decisions regarding financial or legal matters without first consulting with a qualified, licensed professional. Adjust the life of asset slider to the number of years you expect the asset will last or the number of years you plan to use the asset for. The information provided on this website does not constitute insurance advice.

How to Calculate Straight Line Depreciation (Step-by-Step)

It has wide application to many fixed assets, especially when their obsolescence is simply due to passage of time. Straight-line depreciation is an accounting process that spreads the cost of a fixed asset over the period an organization expects to benefit from its use. Depending on how often they are used, different assets can wear out at different rates, and any method of calculating depreciation value may come in handy. Small and large businesses widely use straight line depreciation for its simplicity, accuracy, and functionality, but other methods of calculating an asset’s depreciation value exist.

- However, the useful life of the equipment in this example equals the lease term so at the end of the lease, the asset will be depreciated to $0.

- At the end of the equipment’s ten-year life period, Jason sells the equipment to a used parts store.

- Before you can calculate depreciation of any kind, you must first determine the useful life of the asset you wish to depreciate.

- However, it costs another $100 to ship the copier to the office.

Straight line depreciation is used to calculate the depreciation, or loss of value over time, of fixed assets that will gradually lose their value. A fixed asset is an asset that will be used for a long period of time. It’s impossible to maintain accurate financial records for your company without correctly calculating depreciation on your business assets.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Written-down value is the value of an straight line depreciation after accounting for depreciation or amortization. It is calculated by dividing the difference between an asset’s cost and its expected salvage value by the number of years it is expected to be used. Straight line basis is calculated by dividing the difference between an asset’s cost and its expected salvage value by the number of years it is expected to be used. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support. Straight-line depreciation is different from other methods because it is based solely on the passage of time. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. The formula can also carry out two different depreciation calculations, and then select the calculation that returns the highest value to use for the deprecation.

Cash and paper money, US Treasury bills, undeposited receipts, and Money Market funds are its examples. They are normally found as a line item on the top of the balance sheet asset. We can also calculate the depreciation rate, given the annual depreciation amount and the total depreciation amount, which is the annual depreciation amount/total depreciation amount. Straight-line depreciation is a simple method for calculating how much a particular fixed asset depreciates over time.

Straight-line method of depreciation

To calculate depreciation using a straight line basis, simply divide net price by the number of useful years of life the asset has. Company KMR Inc. has purchased a new delivery truck for an all-in purchase price of $100,000 . It paid with cash and, based on its experience, estimates the truck will likely be in service for five years . Divide the depreciable asset cost by the number of years the asset is estimated to be in use. The machinery has an estimated salvage value of £1,000 and an expected useful life of ten years. Calculate the estimated useful life of the asset – this is how many years the asset is expected to remain functional and fit-for-purpose.

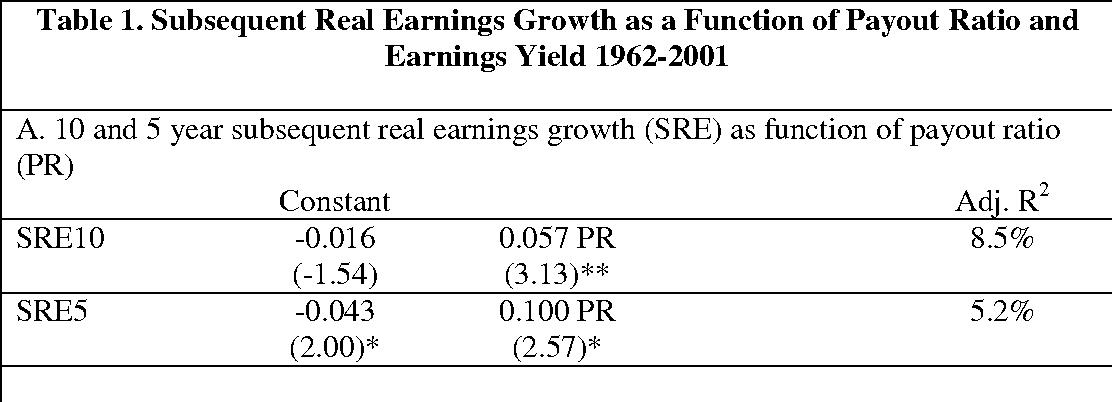

What is the formula for calculating depreciation?

Straight Line Depreciation Method = (Cost of an Asset – Residual Value)/Useful life of an Asset. Unit of Product Method =(Cost of an Asset – Salvage Value)/ Useful life in the form of Units Produced.

It represents the amount of value the owner will obtain or expect to get eventually when the asset is disposed. Cash Flow StatementA Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business. Are reduced by $ and moved to the Property, plant, and equipment line of the balance sheet.

How Much Does Commercial Property Insurance Cost?

Also, if revenue generated by the fixed asset is constant over the useful life, the straight-line method may be the best choice, such as for a building owned for rental by a landlord. As a business owner, knowing how to calculate straight line depreciation of your company’s fixed assets is crucial to your business’s success. When keeping your company accounting records, straight line depreciation can be recorded on the depreciation expense account as debit and credit on the accumulated depreciation account. The straight line method of depreciation is the simplest method of depreciation. Using this method, the cost of a tangible asset is expensed by equal amounts each period over its useful life. The idea is that the value of the assets declines at a constant rate over its useful life.